I worked in a governmental project in which we improved the procurement and tendering system, procedures, and processes for the Ministry of Municipal Affairs in one country of the Middle East. The project required me to study all of the municipality’s processes for each city. I came across many factors which negatively impacted the purchasing system and which prevented any competitive advantage from being gained by vendors. Some of these factors included absence of trust between both parties (buyers and sellers), lack of knowledge about the government system; both parties were working separately and following traditional procedures rather than realising benefits. I'd argue that the Agile mindset “Customer collaboration over contract negotiation” (PMI-Agile, 2017, p.8) can contribute positively to adding values and increasing the competitive advantage for all contractual parties.

Introduction

Procurement refers to all the aspects and processes involved in obtaining goods or services, including factors such as requirements, consideration of risks, supplier contracts and tendering and performance management of suppliers (Crescent Purchasing Consortium, 2015); purchasing and buying are thus also aspects of this. As a significant aspect of doing business, it is essential to ensure that the procurement process is managed in a way that enables for provision or enhancement of competitive advantage to the organisation. Procurement can provide for competitive advantage through improved relationships with suppliers, improved products or services, reduced costs, and ultimately improved client/customer loyalty (Kim et al., 2015, p.2).

Delivering Competitive Advantage

Organisational Strategy can be viewed as a roadmap for the organisation to achieve its goals (Patanakul & Shenhar, 2012, p.6). Strategy is used to create value and can, therefore, be used to maximise and deliver competitive advantage for organisations (Patanakul & Shenhar, 2012, pp.6-7). Through using strategy across the organisation, including in procurement, an organisation can achieve an advantage even in competitive environments, carefully configuring resources to deliver stakeholders' expectations (Johnson et al., 2008, p.3). Thus, Strategic Procurement can deliver competitive advantage by ensuring all procurement takes place in line with the organisation's strategic goals (Meehan, 2015). Organisations must develop excellent relationships with suppliers, ensuring they too understand the organisation's strategic goals and brand. Obtaining competitive value may not merely be a matter of reducing item cost: other factors such as quality or effect on reputation are also critical (Meehan, 2015). Managing such factors well ensures the organisation can maintain competitive advantage through factors such as customer loyalty, brand reputation, or adaptation of new technology.

Maximising Competitive Advantage

A significant area in which Competitive Advantage can be maximised is in Supplier Relations and Negotiations. Ensuring suppliers are on board is critical; thus the negotiating process must focus on overall costs, not on individual unattainable prices and win/lose bargaining (Johnson & Flynn, 2015, p.316). Working together allows for a focus on opportunities to improve competitiveness for both parties, and areas where costs or risks could be reduced or eliminated (Johnson & Flynn, 2015, p.316). This is known as strategic sourcing, or strategic procurement, a framework allowing organisations to add value, maximise competitive advantage, and develop robust supplier relationships (Kim et al., 2015, p.1). Organisations must also focus on the internal aspect of procurement, ensuring effective and efficient internal communications throughout the process to ensure the procurement process is handled suitably, accurately, and is in line with strategic objectives (Kim et al., 2015, pp.1-2). This prevents unnecessary spend and ensures that procurement supports both the organisation's goals and delivers competitive advantage. Upper management must also understand the procurement process, and must both listen to their staff and promote communications - interdepartmental and external - throughout procurement (Tassabehji & Moorhouse, 2008, p.56). Doing so will create relationships which promote collaborative working between companies, which suppliers understanding the needs, fundamental interests and requirements of their buyers.

Competitive Advantage: Personal Experience

Within the Software/IT Sector, I feel two factors are essential in maximising/obtaining competitive advantage in the Procurement Process. First, executives must understand the procurement process and promote best practices in purchasing. Commonly, upper management focus on the bottom line, the price, rather than considering the overall picture (Cox et al., 2004, p.26); or they provide overly-large concessions to suppliers in the name of to maintaining relationships, which, research shows, reduces competitive advantage (Johnson & Flynn, 2015, p.316). As we often use new or cutting-edge technology, establishing strong supplier relationships provides for supplier understanding of our goals, and thus enables competitive advantage through providing space for both buyer and seller to work together to procure the most suitable product or service which supports the strategic objectives. I would also argue purchasing cooperatives are an area which could be more deeply explored by IT/IS sector firms as they support several advantages including decreasing costs, economies of scale, and promote innovation (Mazero & Loonam, 2010, p.148), factors crucial in this sector.

The impact of contract type on project success or failure

When considering project success or failure, one important factor we must address is the contract between buyer and seller. So far, much of the literature examined has not discussed the effect of contract choice on the ultimate outcome of the project. I argue that the contract type and source selection criteria are critical factors in project success/failure.

Major types of contracts used include Fixed Price, Cost-Reimbursable, and Time and Material (PMI, 2017, pp.471, 472), each having different advantages and disadvantages, and being suited to different projects. There is often a common conception, especially in Government projects, that Buyers can use Firm Fixed Price (FFP) or Lump Sum contracts which transfer risk and responsibility to the seller. They are one of the most commonly used kind of contracts (PMI, 2017, pp.471, 472). Often the source selection criteria used in selecting FFP contracts focuses on the lowest cost possible. Product costs are considered while lifecycle costs often are not.

Research conducted by BAA prior to the Heathrow Airport Terminal 5 megaproject indicated that projects with FFP contracts often experience adversarial practices, delays in delivery, budget overruns, poor integration, in addition to disputes and legal battles between clients and contractors (Davies et al., 2009, p.108). Thus, FFP contracts are not always well-suited for large or complex projects due to the effect on the working practices. Buyer and Seller competition rarely results in a successful project outcome; as noted by BAA (Davies et al., 2009), the buyer can never really absolve themselves of responsibility and risk; they will always have to pay, whether in dealing with risks, or in fees associated with a failed project and/or legal fees and disputes.

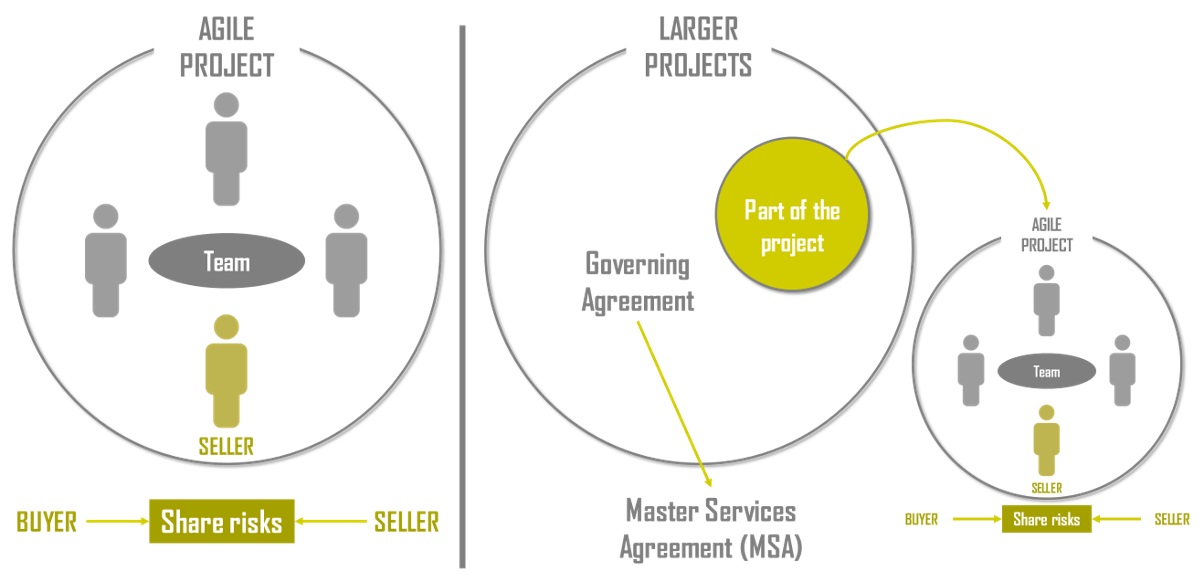

For large or complex projects, or ones with an undefined scope, Time and Material contracts, as hybrids of both FP and Cost Reimbursable contracts, may be more suitable. This collaborative approach shares both risks and rewards, thus all sides win (PMI-Agile, 2017, p.77), leading to project success. The Agile approach to project management promotes teamwork; the seller becomes part of the Project team (see image below) and Megaprojects can be subdivided into small batches, using a Master Services Agreement (MSA) which allows more flexibility for items subject to change.

Evidently when considering vendor selection criteria, we must consider contracts. I worked on a number of fixed price projects, all of which were challenging to both buyer and seller due to the adversarial attitude employed by both parties. In contrast, when Time and Material contracts were implemented, those projects were delivered successfully. As PMI Agile Practice notes, "Many project failures stem from breakdowns in the customer–supplier relationship. Projects incur more risk when those involved in the contract take the perspective of winners vs. losers." The benefit of the Agile approach is that the seller becomes part of the project team, thus enhancing the opportunities for successful project outcomes.

Nowadays, software projects are moving towards a more agile approach, using agile contracts too, which allow buyers to evaluate sellers over the course of short periods of time, rather than giving the whole project to one seller as happens with FFP contract types. Not every seller is well suited to an organisation’s environment. Therefore, some projects will engage several potential sellers for initial deliverables and work products on a paid basis, to allow the buyer to assess the suppliers' capability before making a full commitment to the supplier for a larger portion of the project scope. This allows for greater efficiency since the buyer can be evaluating potential partners, while still making progress on project work. This is called "Trial engagements" (PMI, 2017, p.464).

Source

Published at pmmagazine.net with the consent of the author

Majed Abdeen

About author

PMO Director at EYA Pro

Majed Abdeen

PMO Director at EYA Pro

Total Articles: 8Organizational Project Management (OPM) 2 General 2 Procurement Management 4